Buying the Dip Is a Trap for Most Investors

Buying the dip is for people who don't have enough money for it to matter if they lose everything. The greatest investors of all time aren't crazy risk takers. The advice you see online isn't from the greats, but from the cons who sell you a dream that doesn't exist. Paul Tudor Jones said it best himself, risk control is the most important thing in trading. Everyone else, of course, is just blind to risk. They buy at the top and they sell at the bottom. With many of the greatest investors sitting on the sidelines right now, you should probably take notice.

Buying the Dip Is a Trap for Most Investors

Buying the dip is for people who don't have enough money for it to matter if they lose everything. The greatest investors of all time aren't crazy risk takers. The advice you see online isn't from the greats, but from the cons who sell you a dream that doesn't exist. Paul Tudor Jones said it best himself, risk control is the most important thing in trading. Everyone else, of course, is just blind to risk. They buy at the top and they sell at the bottom. With many of the greatest investors sitting on the sidelines right now, you should probably take notice.

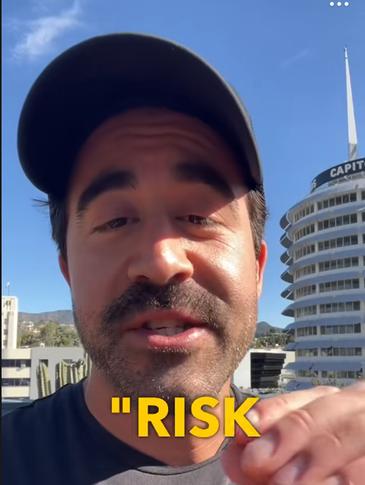

In this viral video, Nicholas Crown challenges one of the most popular mantras circulating in retail investing circles: “buy the dip.” He argues that this advice is dangerously oversimplified and often promoted by influencers who have nothing to lose — or worse, something to sell. Crown sharply contrasts the speculative behavior encouraged online with the caution exercised by the greatest investors of all time, highlighting Paul Tudor Jones’ principle that risk control is the most important thing in trading.

The core message is that buying dips is often less about opportunity and more about overconfidence, especially among small or inexperienced investors. According to Crown, if you don’t have enough capital where losses materially affect your life, you're playing a game of ego and illusion rather than real wealth-building. The most successful investors, by contrast, are often on the sidelines during high-risk periods — waiting, watching, and prioritizing capital preservation.

This video went viral because it delivers counterintuitive advice with authority. In a sea of TikTok content filled with reckless optimism, Crown’s message stands out for its sobriety and credibility. He doesn’t talk about 10x gains or getting rich fast. Instead, he delivers a cold, experienced voice that appeals both to skeptical investors and those who have already been burned.

Another reason the video resonated is the psychological comfort it offers. Many viewers may be feeling unsure or guilty about not jumping into the market — this clip validates that hesitation and reframes inaction as a smart move. It also references legendary names like Paul Tudor Jones, anchoring the message in real-world investing wisdom, rather than hype.

In summary, this video exploded in popularity because it debunks hype with hard truth, delivering a clear and powerful reminder: wealth isn’t built by chasing dips — it’s built by managing risk. Crown’s tone, content, and timing combine to create a message that feels rarely heard but urgently needed in today’s overly confident online financial world.

Did you enjoy this video?

Leave your email address and we’ll deliver the best content from top business minds in the world — in the category you choose.