Why This Reel Hit 2 Million Views (And Deserved It)

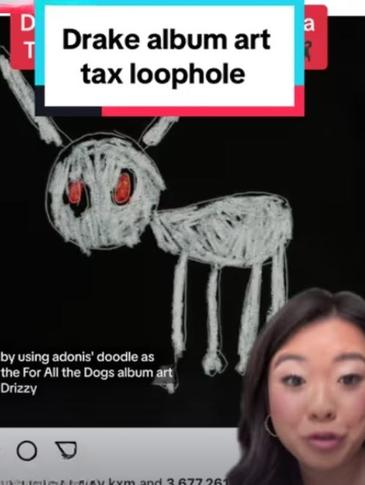

They don't call this man Champagne Poppy for nothing. By using Adonis' doodle as the For All the Dogs album art, Drizzy Drake just guaranteed his little guy nearly $9 million in retirement, totally tax-free. And you don't even need Drake-level money to do this. I'm Vivian, your rich BFF and your favorite Wall Street girlie, and I can show you how. Step one, our man Drake is opening up a custodial Roth IRA for his son. It's a retirement account opened up for minors by a guardian.

Step two, to contribute to a Roth IRA, kiddo has to have earned income, aka money they made. In Drake's case, he could set up a contract to pay his son a licensing fee to use this as cover art. But in your kid's case, they could babysit, or Milan's, or be paid through your business, such as onscreen talent if you're a mommy blogger, or as a barista or a waiter if you own a restaurant, et cetera. And last, the father-son duo would then use that money to buy investments. I would recommend something like an index fund that tracks the S&P 500.

Since Adonis is five, if Drake kept this up for 55 years until Adonis' retirement age at 60, he'll have contributed $357,500 into this account for his son. But due to compound interest and investment growth, Adonis would have roughly $9 million, assuming an annual 9% return, which is what it has returned roughly for the past 20 years. I wasn't born rich, but my kids sure will be. And if you want to set your kids up financially too, I can show you how. Follow for more.

Why This Reel Hit 2 Million Views (And Deserved It)

They don't call this man Champagne Poppy for nothing. By using Adonis' doodle as the For All the Dogs album art, Drizzy Drake just guaranteed his little guy nearly $9 million in retirement, totally tax-free. And you don't even need Drake-level money to do this. I'm Vivian, your rich BFF and your favorite Wall Street girlie, and I can show you how. Step one, our man Drake is opening up a custodial Roth IRA for his son. It's a retirement account opened up for minors by a guardian.

Step two, to contribute to a Roth IRA, kiddo has to have earned income, aka money they made. In Drake's case, he could set up a contract to pay his son a licensing fee to use this as cover art. But in your kid's case, they could babysit, or Milan's, or be paid through your business, such as onscreen talent if you're a mommy blogger, or as a barista or a waiter if you own a restaurant, et cetera. And last, the father-son duo would then use that money to buy investments. I would recommend something like an index fund that tracks the S&P 500.

Since Adonis is five, if Drake kept this up for 55 years until Adonis' retirement age at 60, he'll have contributed $357,500 into this account for his son. But due to compound interest and investment growth, Adonis would have roughly $9 million, assuming an annual 9% return, which is what it has returned roughly for the past 20 years. I wasn't born rich, but my kids sure will be. And if you want to set your kids up financially too, I can show you how. Follow for more.

This reel has reached nearly 2 million views because it perfectly blends celebrity culture with financial education. Drake isn’t just clickbait — his move is a brilliant, tax-free financial strategy that naturally sparks curiosity and respect. It's a form of storytelling with strong viral appeal: “Drake gives his son $9 million — legally and without taxes.”

The creator, Vivian, delivers information in a relatable and modern way. Her tone is friendly and easy to understand, like a fast-paced “TikTok MBA” — straight to the point, clear, and educational in under 60 seconds. It resonates with viewers who want to feel smarter after scrolling.

The topic itself is emotionally charged. When you mix kids and money, you're tapping into aspiration and parental instinct. Young parents and millennials immediately connect with the idea of setting their child up for a secure future — even without Drake-level wealth.

More than just motivation, the video breaks down real, actionable steps: open a Roth IRA, show earned income, invest. Viewers walk away with something concrete they can apply in real life.

Vivian’s strong personal brand plays a major role. As “your rich BFF and Wall Street girlie,” she brings charisma, trust, and authority. People know they’re getting valuable advice from someone who knows her stuff.

Finally, the reel invites engagement. It triggers questions like “Is this even legal?”, “Why didn’t anyone teach me this?”, or “This is the future.” That drives shares, saves, and comments — which helps the algorithm push it even further.

Did you enjoy this video?

Leave your email address and we’ll deliver the best content from top business minds in the world — in the category you choose.